Bitcoin Halving

Understanding the Bitcoin Halving: A Historical Overview and Future Predictions

Bitcoin halving is a significant event in the cryptocurrency world that affects miners, investors, and the overall market dynamics. This event, which happens approximately every four years, reduces the amount of new bitcoins created and earned by miners by half. This process is known as “halving” and is critical to Bitcoin’s supply mechanism. In this blog post, we’ll delve into the “Bitcoin halving history” and analyze the “Bitcoin halving chart” to understand the implications of this event.

What is Bitcoin Halving?

Bitcoin halving is a part of the decentralized network’s monetary policy, instituted by Satoshi Nakamoto, the creator of Bitcoin. The halving decreases the rate at which new bitcoins are generated on the blockchain, thus slowing down the supply of new coins. The reason for implementing this feature was to create scarcity to help control inflation, an issue prevalent in traditional fiat currencies where governments can print money at will.

Historical Perspective on Bitcoin Halvings

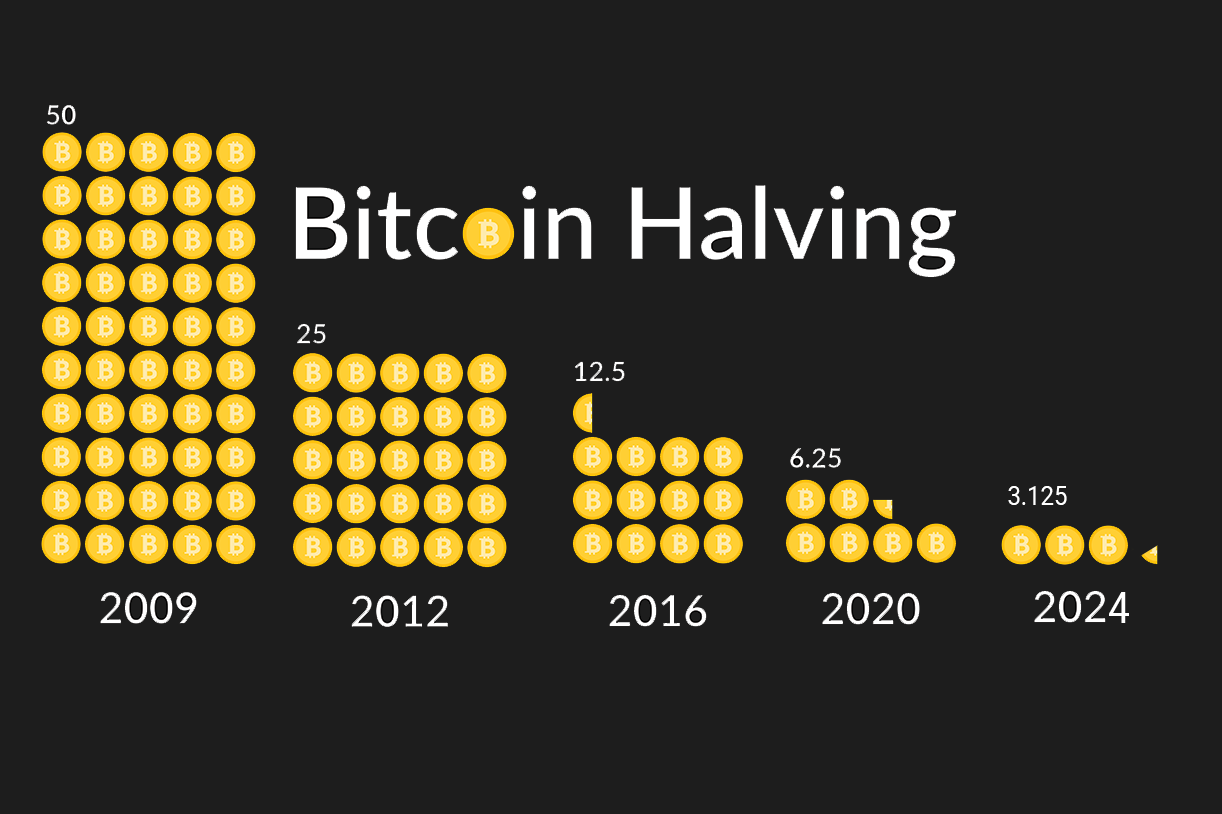

The first Bitcoin halving occurred in November 2012, when the mining reward was reduced from 50 bitcoins per block to 25 bitcoins. This event marked the beginning of a new era for Bitcoin’s economy. The second halving took place in July 2016, reducing the reward further to 12.5 bitcoins. The most recent halving, in May 2020, saw the reward drop to 6.25 bitcoins. Each of these events has been pivotal in shaping the economic landscape of Bitcoin by adjusting the supply and incentivizing miners.

Bitcoin Halving Chart Analysis

A “Bitcoin halving chart” visually represents these significant moments in Bitcoin’s history. By analyzing this chart, one can see the pattern of how each halving event leads to a reduced pace of new Bitcoin creation. The chart typically displays a timeline on the x-axis and the mining reward size on the y-axis, clearly marking the halving points. In the picture below, you can easily see how much the mined amount has decreased in each halving.

The Future of Bitcoin Mining

Looking ahead, the next Bitcoin halving is expected to occur in 2024, which will decrease the reward for mining a block to approximately 3.125 bitcoins. As the reward decreases and the difficulty of mining increases, it will require more computational power and thus more energy to mine new bitcoins. This increased difficulty means that only the most efficient mining operations will remain profitable, potentially leading to further centralization of mining power unless new, more efficient mining technologies are developed.

Challenges and Opportunities

The increasing difficulty of mining new bitcoins can be challenging for miners as their profitability may decrease. However, it also creates a potential for higher prices due to reduced supply. Historically, each halving has been followed by an increase in Bitcoin’s price, although past performance is not indicative of future results.

For investors, understanding the impact of halving is crucial as it can influence investment decisions. For miners, adapting to the increasing difficulty is key to maintaining profitability. Meanwhile, the overall community continues to watch these events closely as they significantly influence the path and perception of Bitcoin as a digital asset.

Conclusion

Bitcoin halving is a fundamental event that reassures the strength of Bitcoin’s original design and its inflation-resistant qualities. While it presents challenges, particularly in mining, it also offers opportunities for appreciation and growth. Whether you are an investor, a miner, or just a curious observer, the Bitcoin halving is a key event that should not be overlooked in the landscape of cryptocurrency.